Attention Dealers: This is a free resource of the California Used Car Dealer Insurance Buyer’s Guide, version 2.0. Future refinement and / or additions will be incorporated as appropriate. We ask that you please review it in its entirety.

Buyer’s Guide Topics:

- Used Car Dealer Insurance of California Buyer’s Guide

- Operating without a Dealer Insurance Policy

- Navigating through the Dealer Licensing Process

- Acquiring the Right Insurance Producer

- New in Business (aka New Ventures)

- Loss Runs (or Loss History)

- 5 Dealer Insurance Quicktips

- Obscure Coverages to Consider

- What to Anticipate During an Inspection

- Monthly Payment Purchase Price Disclosure

- Prohibited “Certified” Used Vehicles

- Record of Complaint Form

- Dealer-to-Dealer Disputes

- 7 Well-Advised Practices to Follow

- Buyer’s Guide Disclaimer

- Personal Note from the Founder of the Used Car Dealer Academy

Used Car Dealer Insurance of California Buyer’s Guide

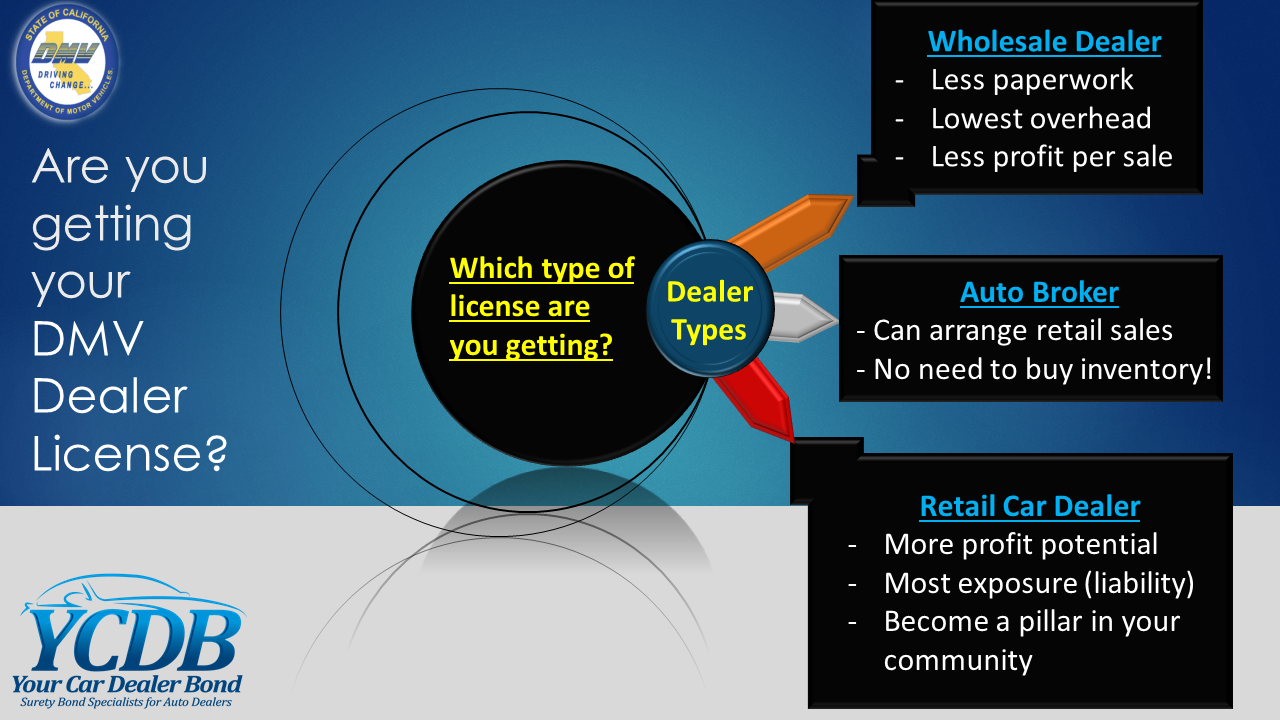

The Car Buyer’s Bill of Rights affects wholesalers, auto brokers, and retail auto dealers across the state of California.

The California Department of Motor Vehicles (DMV) maintains a series of rules and regulations for individuals seeking to obtain or renew a dealer license. A car dealer bond is required in the amount of $10,000 or $50,000 depending on the dealer type and sales volume. It is incorrect to assume, however, that a car dealer bond offers the same coverage as auto dealer insurance.

Operating Without a Dealer Insurance Policy

There are two main reasons for operating without auto dealer insurance:

- There is no law or requirement that used car dealers carry auto dealer insurance

- Wholesalers believe their personal auto insurance policy extends coverage to vehicles purchased under their business license

Because of the reasons listed above, many licensed used car dealers across the state make the unwise decision to avoid purchasing a policy, placing the consumer in harm’s way, creating hundreds of unpaid claims annually. But this reasoning is inaccurate and potentially costly. There is an exclusion section of an auto insurance policy that disallows business purpose claims.

Statistics indicate that at any given time, at least 45% of licensed motor vehicle dealers fail to carry a dealer insurance policy, and in economically challenging times, that percentage increases to an alarming 60%!

A wise dealer makes certain that inventory is purchased from a wholesaler who carries insurance. The purpose for the development of the California Used Car Dealer Insurance Buyer’s Guide is to expose loopholes in the law and bring clarity to a variety of dealer insurance-related questions.

Navigating through the Dealer Licensing Process

Use this great resource to lead you through the process of becoming a licensed used auto dealer. Click on the image to be routed to our free dealer pre-licensing resource.

Choosing the Right Broker for Your Used Car Dealer Insurance

Most producers do not specialize in Used Car Dealership Insurance nor have access to companies who write this type of insurance. It is imperative you search for a company that is both knowledgeable and prepared to build a policy that is specifically for your dealerships needs.

Experience matters! Deductibles, sub-limits, minimum limits, aggregate exposure, total insured value, and prior damage are just a few of the most common terms that a well-informed insurance producer understands and can easily explain.

New in Business (aka New Ventures)

Insurance companies generally request a resume from new dealers (i.e., operations in business less than 36 months) to substantiate their experience in the garage automotive industry. In addition, an insurance company will want to know the amount of investment capital as well as other information typically included in a business plan.

New Ventures are frequently surcharged 10 – 20%, depending on the rating plan of your insurance carrier. Reason being, it is this segment of the industry that generates the most insurance claims.

Loss Runs

Loss runs or loss history, reports provided by your insurance company that certify claim activity on each of your policies, are available to you free of charge.

- The request must come directly from the insured and must be in writing (mailed request, fax, or email) to obtain a loss history report

- Once the insurance company receives the request, it must be fulfilled within 10 business days

- If planning to switch the insurance company for your next policy term, request a loss run report approximately 45 days prior to the policy expiration date and request it for the previous 36 months. This is because your new insurance company will request the loss history to be able to provide you with an accurate quote.

5 Used Car Dealer Insurance Quicktips

- Inventory Coverage – Includes purchase price and the reconditioning on your autos but does not include expected profit*. An example is:

- Purchasing a car at the auction for $2,000 and then spending $500 to get it ready for resale. If this vehicle becomes a total loss, you would claim $2,500, however, after your deductible is applied, which is more than likely $1,000, you will only receive $1,500 from your insurance company for this vehicle.

* It does not matter how much you were intending to sell the vehicle for because your “expected profit” is not covered.

- The Importance of Garagekeepers Coverage

Garagekeepers Coverage is designed to protect against claims arising from physical damage to vehicles owned by others that are left in your care, custody or control. This includes vehicles that are being serviced, repaired, stored, and test-driven.

- Is Medical Payments Coverage beneficial even if I carry medical insurance?

Medical Payments Coverage medical expenses sustained by you and / or your passengers if involved in an accident in a covered auto. It can also be used for small claims on your premises such as customer’s trip or fall.

- What is Scheduled Vehicle Coverage?

Supplies liability and physical damage coverage to vehicles specifically listed on your policy. This coverage should be considered when a vehicle is owned by you or your spouse, rather than in the business name.

In most cases, it makes most good business sense to dissolve your personal lines auto insurance policy that you carry through companies such as Geico or Progressive. Having insurance on the personal exposures under your car dealer policy may result in having more coverage for less money. By doing so, you can write-off the cost as a legitimate business expense.

- What is Contents Coverage?

Contents Coverage provides replacement costs for your personal property, including leased business personal property for which you are contractually responsible, in the event of a fire, burglary, vandalism, and collapse. Examples of personal property include computers, tools, furniture, fixtures, machinery, and other equipment.

Obscure Coverages to Consider

- Damage to Rented Premises Coverage (DTRP)

- Also known as Fire Legal Liability, this coverage provides liability for property damage caused by a fire to premises leased or rented to you and arising out of your own negligence

- Broad Form Drive Other Car Coverage

- For businesses not individually owned, this coverage may be used to extend the garage policy to provide insurance for partners or corporate officers who do not carry their own personal auto policy when borrowing or renting cars in their name. The individuals named in the endorsement become insureds while using autos they do not own.

- Broad Form Products

- Provides coverage for property damage to its product(s) even if the resulting damage was caused by a defect existing in the product at the time of customer purchase

- False Pretense Coverage

- Coverage provided in the event that the insured is tricked or schemed into voluntarily parting with a covered auto or the insured acquires an auto from a seller who did not have legal title

What to Anticipate During an Inspection

Also known as a loss control or a loss prevention inspection, these in-depth inspections are scheduled and conducted generally within 30 days from your policy effective date. Inspectors compose an extensive report on your dealership and report back to the insurance company. The insurance company then compares the report to your application to reveal hazards posed to your business.

Inspections can help maintain a more cost-effective dealership insurance policy and a safer environment for you and your employees. The fewer the hazards means you are less of a risk to the insurance company, resulting in lower premiums. Keep in mind that an inspection of your business for insurance purposes is for the benefit of your dealership. If an inspector uncovers a potential hazard, you will be allowed a reasonable opportunity to correct the issue in order to maintain your current insurance rate.

Monthly Payment Purchase Price Disclosure

The dealer must provide a written document with the price of specified items purchased along with the amount of the monthly installment payments (California Civil Code §2982).

- Items requiring disclosure include a service contract, insurance product, debt cancellation agreement (“gap” insurance), theft deterrent device, surface protection product, and contract cancellation option agreement

- No charges may be added to the contract without full disclosure and your consent

- The document must include the cost of the monthly installment payments with and without items listed

Prohibited “Certified” Used Vehicles

Used cars advertised as “certified” must meet specific requirements. The dealer must perform a complete inspection of the vehicle and provide consumers with a copy of the inspection report.

Dealers are prohibited from advertising a vehicle as “certified” if the:

- Odometer does not indicate an accurate mileage reading of the vehicle

- The vehicle was reacquired by the manufacturer or dealer under state or federal warranty law (i.e. “lemon law”)

- Your vehicle was damaged by a collision, fire, or flood unless repaired to safe operational condition prior to sale

- The title was branded as a lemon law buyback, manufacturer repurchase, salvage, junk, non-repairable, flood, or similar designation

- Your Vehicle has frame damage or was sold “as is”

- Seller failed to provide the buyer with a complete inspection report of all components inspected

Important Note:

- Check http://www.safercar.gov to determine if your vehicle has a safety recall notice that has not been repaired

Record of Complaint Form

If a dealer fails to comply with their legal obligations, complete a Record of Complaint Form (INV 172A) and mail it to the Department of Motor Vehicles at one of the addresses listed on the form. Prepare your case prior to communicating with a DMV Investigator.

Dealer-to-Dealer Disputes

Whenever possible, attempt to resolve the problem with the other party or firm. If unable to obtain a resolution, consider contacting a private attorney, the small claims division of your local county court, or a legal aid group for assistance. Refer to the County Government section of your local telephone directory for the county court in your area.

7 Well-Advised Practices to Follow

- Store keys to your vehicles in a secure, hidden location during business hours and in a lockbox during non-business hours

- Prohibit employees not listed on your insurance policy from operating your vehicles

- Post restricted area signs in sections of your buildings and premises where only employees are allowed

- Photocopy the customer’s driver license and personal auto insurance card prior to an accompanied test drive and obtain a signed test drive agreement indicating their policy as primary. Limit the test drive to a predetermined route and lasting no more than 20 minutes.

- Report all new hires to your insurance company immediately after hiring

- Service fire extinguishers on an annual basis by a licensed contractor or by the local fire department

- Never loan your dealer plates to anyone under any circumstances

California Used Car Dealer Insurance Buyer’s Guide Disclaimer

This California Used Car Dealer Insurance Buyer’s Guide was designed solely as a guide. It was developed as an added service to dealers with insurance questions and to explain certain topics in greater detail. The California Department of Insurance and the California Department of Motor Vehicles websites should be referenced for more official information.

Personal Note from the Founder of the Used Car Dealer Academy

Greetings, Dealers –

I created this California Used Car Dealer Insurance Buyer’s Guide in hopes that it would be of value to you.

To that end, it is beneficial for me to hear how this content can improve. I would appreciate it greatly if you could please communicate your feedback to me at the email address below. Such examples of useful feedback is whether this is the appropriate amount of detail you require and whether this information is relevant in establishing your prosperous used car dealership.

Here to be of service,

Mike Ramos

***********************************

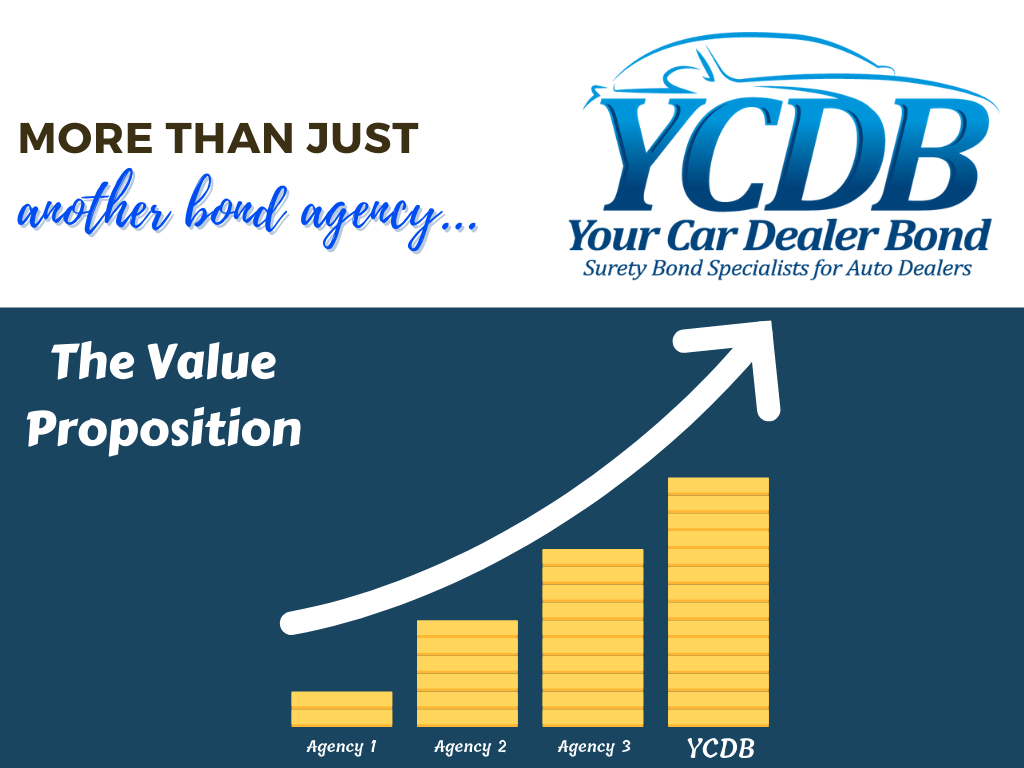

We would love a chance to earn your business…

YCDB Social Media:

Check out Mike Ramos from Your Car Dealer Bond on LinkedIn:

https://www.linkedin.com/pub/mike-ramos/65/a1a/775

Check out Your Car Dealer Bond on YouTube.

Leave a Reply