I’m willing to bet that you have one of or all these 3 challenges with your current Used Auto Dealer Insurance Program:

- Your annual premium is too expensive

- You are not sure how your coverages work and where you are self-insuring your dealership risk

- Your insurance broker is not capable or willing to help educate you on how your dealer insurance policy works

The next used car dealer category only purchases the mandatory coverage from their lender (like Nextgear).

After 20 years in the industry, Mike Ramos, president and founder of Your Car Dealer Bond LLC has even more insight to offer about this subject matter…

And then there are dealers who go without insurance altogether because they’re not mandated to have insurance in California to keep their car dealer license and because they don’t use a lender at all.

The nature of a Used Auto Dealers Insurance Program provided by your lender is that only your inventory gets covered but no liability exists.

Whichever category you fall into, we can help you, as we have helped thousands of dealers just like you craft just the right insurance policy to stay within budget and provide peace of mind!

Give us a call if you have questions, or if you would like to start the process of getting a Used Car Dealer Insurance quote.

What should you expect if you are buying a Used Auto Dealers Insurance Policy?

If you are a newly-licensed auto dealer (i.e. dealers in business less than 36 months), expect a surcharge. Generally, a resume or experience questionnaire substantiating your level of experience is how an insurance company might gauge how much that surcharge should be. In addition to industry experience, the insurance companies ask how much capital has been invested and other info that would typically be contained in a business plan.

New Ventures will typically be surcharged 10 – 20%, depending on the rating plan of your insurance carrier. It makes sense since this segment of the industry creates the most insurance dealer policy claims.

How do I prove that I had Used Auto Dealer Insurance?

Loss runs are free of charge and they are reports provided by your insurance company that certify the claim activity on each of your policies.

- To obtain loss history, the request must come directly from the insured and in writing (mailed request, fax, or email.) The date the insurance company receives your request, they have up to 10 business days to fulfill your request.

- If you plan to switch your insurance company for your next policy term of insurance, request loss runs for the previous 36 months and approximately 45 days prior to your policy expiration date. Your new insurance company will request loss history when reviewing to provide a quote.

Assuming that you have not had any claims in the past 3 years, your premium will be quite a bit less than if you do not have your Loss Runs handy.

5 quick-tips to consider if you are purchasing dealer insurance:

1. Inventory Coverage – Includes purchase price and the reconditioning on your autos, but does not include expected profit. Example:

- you buy a car at the auction for $2,000 and put in $500 to get it ready for sale.

- then you can only claim at much as $2,500 if this vehicle is a total loss.

- You would likely have a $1,000 deductible that the insurance company would cut you a check for $1,500 if you had a total covered loss.

* It does not matter how much you were planning on selling that vehicle for since your “expected profit” is not covered.

2. Why should every dealer have Garagekeepers Coverage?

Garagekeepers Coverage is designed to protect you against claims arising out of physical damage to vehicles owned by others that are left in your care, custody, or control. This includes vehicles that are being serviced, repaired, stored, and test-driven.

3. How is Medical Payments Coverage useful even if I have personal medical insurance?

Medical Payments Coverage covers medical expenses sustained by you and/or your passengers if involved in an accident in a Covered Auto. It can also be used for small claims on your premises such as a trip and fall by a customer.

4. What is Scheduled Vehicle Coverage and why should I purchase it?

Scheduled Vehicle Coverage provides Liability and Physical Damage Coverage to vehicles specifically listed on your policy. This coverage should be considered when you own a personal vehicle in yours or your spouse’s personal name, rather than the business name.

In most cases, it makes most sense to dissolve your personal lines auto insurance policy that you carry through Geico or Progressive. Insuring those personal exposures under your car dealer policy can result in having more coverage for less money. The icing on the cake is being able to write off the cost as a legitimate business expense.

5. What is Contents Coverage and why should I purchase it?

Contents Coverage provides replacement cost for your personal property, including leased business personal property you have a contractual responsibility to insure in the event of a fire, burglary, vandalism, and collapse. Consider your computers, tools, furniture, fixtures, machinery and equipment.

Coverages to Consider for Reasons Less Discussed

- Damage to Rented Premises Coverage (DTRP)

- Also known as Fire Legal Liability, provides liability coverage for property damage caused by a fire to premises leased or rented to you and arising out of your negligence.

- Broad Form Drive Other Car Coverage

- For businesses not individually owned this coverage may be used to extend the garage policy to insure partners or corporate officers when they borrow or rent cars in their name and do not have protection of their own personal auto policy. The individuals named in the endorsement become insureds while using autos they do not own.

- Broad Form Products

- Provides coverage for property damage to its product(s) even if the resulting damage was caused by a defect existing in the product at the time it was sold to a customer.

- False Pretense Coverage

- Provides coverage in the event the insured is tricked or schemed into voluntarily parting with a covered auto or the insured acquires an auto from a seller who did not have legal title.

What Should I Expect During an Inspection?

Also known as a loss control or a loss prevention inspection. These in-depth inspections are scheduled and conducted generally within 30 days from your dealer insurance policy effective date. Inspectors write up an extensive report about your dealership and report back to the insurance company. The insurance company then compares the report to what’s disclosed on your application and looks for hazards threatening your business.

Inspections can help you save money on your dealership insurance and keep you and your employees safe. The fewer hazards you have that threaten your business, the less risky you are to the insurance company, which means your premiums should not be increased upon this inspection. Remember, an inspection of your business for insurance purposes is nothing to be nervous about. If an inspector finds something that you need to fix to maintain your insurance rates, you’ll be given plenty of time to do so before any action is taken.

5 Great Safe Practices to Follow:

- Keys to your vehicles should be secured in a safe hidden place during business hours and in a lockbox during non-business hours.

- Do not allow drivers to operate your vehicle if they are not listed on your dealer insurance policy.

- Have your fire extinguishers serviced on an annual basis by a licensed contractor or by the local fire department.

- Prior to an accompanied test drive, you take a photo copy of the customer’s driver’s license and personal auto policy. Have the individual sign a test drive agreement that indicates their insurance is primary. You should also limit the drive to 30 minutes and on a predetermined route.

- Report all new hires to your insurance company immediately upon hiring.

Prohibited “Certified” Used Vehicles

Used cars advertised as “certified” must meet specific requirements. The dealer must perform a complete inspection of the vehicle and provide consumers with a copy of the inspection report.

Dealers are prohibited from advertising a vehicle as “certified” if the:

- Odometer does not indicate the actual mileage of the vehicle

- Vehicle was reacquired by the manufacturer or dealer under state or federal warranty law (i.e. “lemon law”)

- Seller failed to provide the buyer with a complete inspection report of all components inspected

- Vehicle was damaged by a collision, fire, or flood unless repaired to safe operational condition prior to sale

- Title was branded as a lemon law buyback, manufacturer repurchase, salvage, junk, non-repairable, flood, or similar designation

- Vehicle has frame damage or was sold “as is”

Important:

- Check www.safercar.gov to find out if your vehicle has a safety recall notice that has not been repaired.

Dealer-to-Dealer Disputes

When possible, attempt to resolve the problem with the other party or firm. If unable to obtain a resolution, consider contacting a private attorney, the small claims division of your local county court, and a legal aid group for assistance. Refer to the County Government section of your local telephone directory for the county court in your area.

Finding the Right Insurance Producer

Most producers do not specialize in Used Car Dealership Insurance nor have access to companies who write this insurance line. It is imperative you search around to find one who not only is knowledgeable with this product, but that is also prepared to build a policy that is specifically for your dealerships needs.

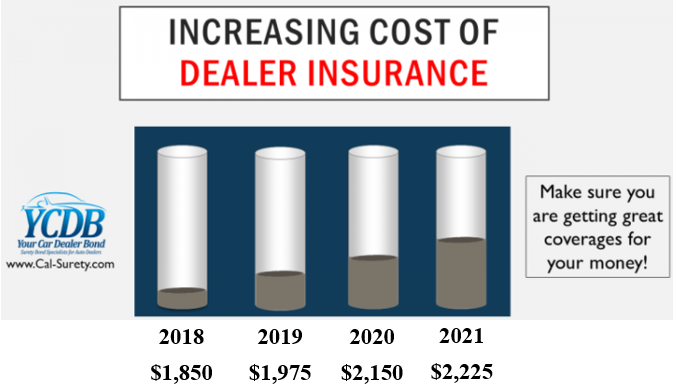

Experience matters and you get what you pay for when it comes to finding the most knowledgeable insurance producers to insurance your dealership needs. Deductibles, sub-limits, minimum limits, aggregate exposure, total insured value, prior damage. These are just a few of the most common terms that a well-informed insurance producer will understand and be able to explain to you in plain terms. If you are going to spend thousands of dollars on insurance every year, you should be getting your money’s worth!

YCDB Social Media:

Follow Your Car Dealer Bond on Facebook:

https://www.facebook.com/pages/Your-Car-Dealer-Bond/395072210503844

Check out Mike Ramos from Your Car Dealer Bond on LinkedIn:

https://www.linkedin.com/pub/mike-ramos/65/a1a/775

Check out Your Car Dealer Bond on YouTube:

https://www.youtube.com/channel/UCxJrz9HmbB7xVMRbeX7kNSw/videos

Leave a Reply